Bitcoin Scarcity

scarce /skers/ adj. (especially of food, money, or some other resource) insufficient for the demand. The gap between limited resources and theoretically limitless wants.

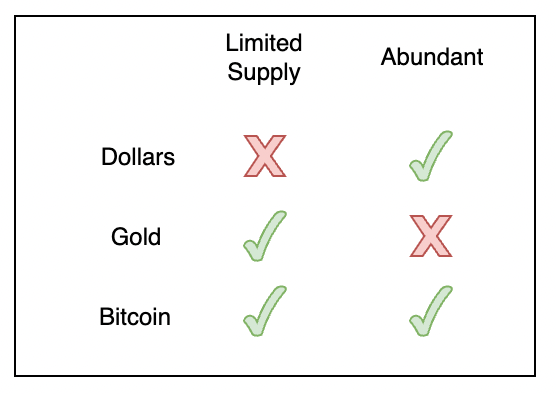

The Bitcoin community talks about scarcity a lot. Something like “the 21 million hard cap means Bitcoin is intrinsically scarce” would be a common statement to see on Bitcoin twitter. While the community is right that the limited supply is a very important foundation of the monetary policy, I have observed on occassion that the loose use of the word “scarcity” can cause people to talk past each other. In particular, a statement like “Bitcoin’s infinite divisibility means that Bitcoin is not scarce” is quickly written off as factually incorrect FUD. However, I’d like to argue that this statement is actually true (in a certain sense), and that’s a good thing.

First let’s get a common understanding of the word scarcity: a “scarce” resource is any resource for which demand is greater than supply. The field of economics is the study of how humans decide to allocate these scarce resources to efficiently (or not) meet peoples needs. If everyone can have as much of the resource as they need or want, the resource is abundant (like air on Earth). If some people must be excluded to a degree, then the resource is scarce. The most simple heuristic to use: in a market economy, anything with a price is scarce.

“But wait! Dollars have a price and we don’t call them scarce! And you just said Bitcoin is not scarce but it does have a price!” … now we’re starting to get at the reason people are talking past eachother, this subtlety can be confusing.

It’s really the fact that we’re talking about money that this subtlety comes into play. Anything that represents abstract wealth will be scarce: the demand for money will always be greater than supply, so long as there’s things to buy with money. However, outside of the “want” for all the wealth, there is another “need” for money which is even more important. Everyone “wants” all the money, but everyone “needs” to have enough to store their fairly earned wages, and participate in trade. So let’s frame the question this way: can a money (Bitcoin, Dollar, Gold) be used by everyone simultaneously to store their own wealth, without exclusion? If so, then the money is abundant for the purpose of fulfilling the “need” of storing wealth. If exclusion of certain people is required, then the money must be scarce.

- Dollars: this money is abundant. Everyone can have a Dollar, we can always make more for no cost.

- Gold: this money is scarce. Pure gold coins are far too valuable to be used to store small amounts of wealth. Of course, gold is divisible down to the atomic level, but there is a cost associated with reducing the amount of gold in a coin (changing the carat). Historically this scarcity problem was solved in several ways such as using silver alongside gold, or expanding the money supply using paper gold receipts.

- Bitcoin: this money is abundant. Everyone can have some sats (or millisats), there is no cost for dividing bitcoin into smaller pieces.

This is really one of the innovations of Bitcoin: an asset that is both abundant (there’s enough for everyone to have a useable amount) and limited in supply (no debasement) simultaneously.

“Bitcoin’s free and infinite divisibility means that Bitcoin is not scarce, and that’s a good thing.”

Appendix: Blockspace Scarcity

One aspect of Bitcoin that is truely scarce is the transactional throughput of the global state (the “block space”). Like bitcoin the asset, the supply of blockspace in bitcoin the network is also of strictly limited supply (4M weight units per block). However, unlike bitcoin the asset, there is a minimum amount of useful weight units when building blockchain transactions, and so during periods of high demand a fee market emerges to exclude certain participants.